Okinawa is a chain of over 150 tropical islands Southeast of mainland Japan. Here you will find more 100+ (centenarians) year old people than just about anywhere else on the planet. Today we will discuss why the phenomenon of Okinawa and other cities like it provide us with important takeaways for you and your portfolio.

At Pawleys Investment Advisors our philosophy is to “Invest Right, Live Right™” This slogan works only if the living right piece comes first. Nothing illustrates the point better than the five Blue Zones. Blue Zones are regions of the world where people consistently live longer and healthier lives than average, with a higher percentage of their populations reaching age 100 than anywhere else in the world. “Blue Zone” was a term coined by researcher Dan Buettner, who identified five original Blue Zones: Okinawa, Japan, Sardinia, Italy, Ikaria, Greece, the Nicoya Peninsula, Costa Rica and Loma Linda, California. But what do the people who inhabit Blue Zones do that allows them to live so long? Researchers found nine shared habits among those living in Blue Zones which they referred to as the Power 9: move naturally all day, know your purpose, down-shift stress, follow an 80 % rule for portions, favor a mostly plant diet, enjoy moderate wine with friends, put loved ones first, belong to a faith/community, and cultivate a close social circle.

What are some of the parallels of Blue Zone habits to your investment style?

First, it is important to understand why the phenomenon of the Blue Zone is important for you and for society. These habits offer evidence based, low-cost strategies to prevent chronic diseases like heart disease, diabetes, and dementia. They can help us reshape health systems to focus more on prevention rather than treatment. They remind us that health isn’t just genetic, it’s cultural, environmental, and behavioral. Let’s look at some of the investing parallels we can gather from Blue Zones…

| Blue Zone Habit | Benefit | Investing Parallels |

| Purpose A strong sense of meaning and daily motivation People continue to feel useful well into old age | This can add up to 7 years of life | You should be investing with a purpose driven plan that keeps you on track in rough markets. |

| 80 % Rule “Hara hachi bu” in Okinawa means to eat until 80% full. | Prevents chronic disease | Spend less than you earn & always leave room in your budget and portfolio. |

| Community & loved ones | Having an emotional safety net | Work with an advisor and peer network for accountability and support. |

Living Right and Investing Right™ go hand in hand. For investors and those who aim to live long, happy and healthy lives here are some final takeaways from the phenomenon of Blue Zones.

- Health is your greatest asset. Compounding only works over a long, healthy life span.

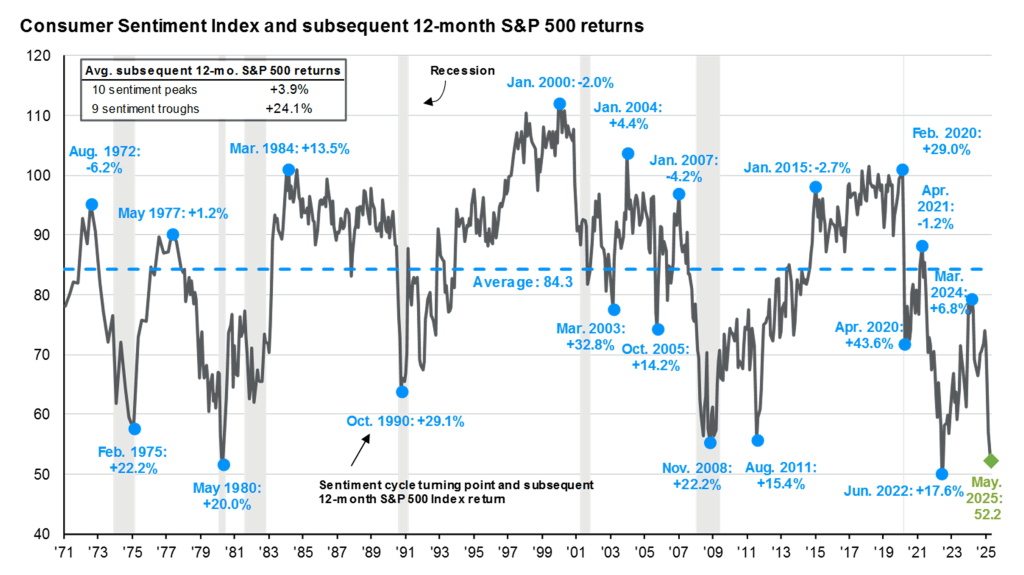

- Lower stress corresponds with better decisions. Blue-Zone down-shifting stress mirrors the calm mindset that investors need to resist panic-selling.

- Moderation beats extremes. Just as centenarians avoid crash diets, disciplined investors avoid gambling on volatile or dicey investments.

When you Invest Right, you build a portfolio that can support decades of purpose-filled living. When you Live Right, you give that portfolio the time it needs to grow.

By Greyson Harris