Before you let headlines dictate your next move, take a breath and look at the data. History shows that the market often hands out its biggest rewards when optimism is scarce and nerves are frayed. In the quick read ahead, you’ll see why staying invested during dark days—and resisting the urge to chase the sunny ones—can make all the difference. Ready to let facts, not feelings, guide your portfolio? Let’s dive in.

Chart 1: Consumer Confidence and the Stock Market

Source: JP Morgan Asset Management

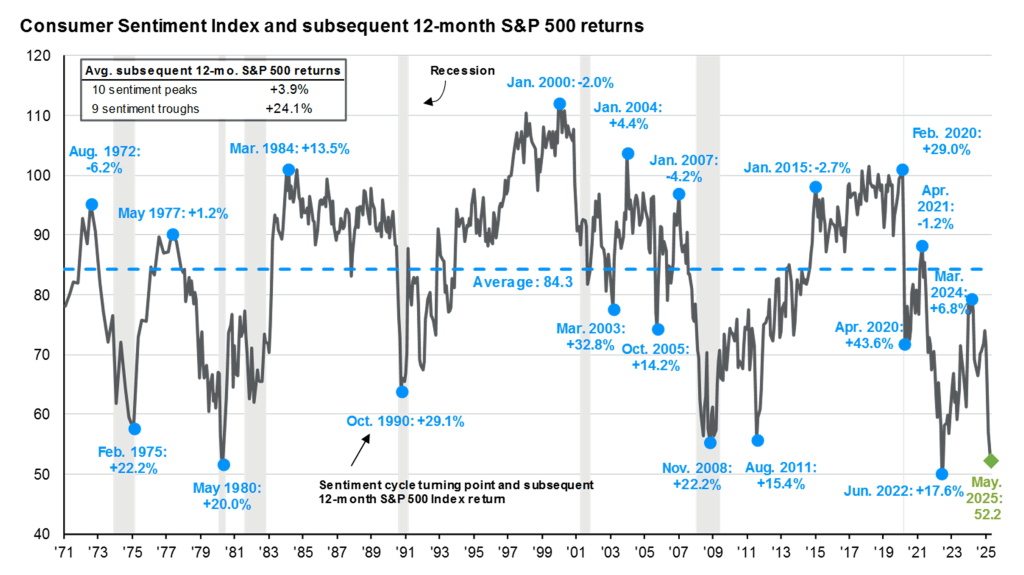

This chart tracks the Consumer Sentiment Index against 12-month S&P 500 returns since the 1970s. When consumer sentiment hits extreme lows (like during recessions), stocks have historically delivered strong 12-month returns—averaging over 24% . At sentiment highs, when optimism runs rampant, returns tend to be much lower—just around 3.9% on average. This pattern reminds us that markets are not always rational in the short term—they react to mood swings, not just fundamentals.

Other Key Takeaways:

1. Fear Drives Sell-offs :

When consumer sentiment dips sharply, as seen during recessions, investors often panic and sell their holdings. However, history shows that these periods of extreme pessimism are often followed by strong market rebounds.

2. Greed Leads to Overexuberance :

On the flip side, when sentiment is overly optimistic, investors may rush into the market without considering valuation risks. This can lead to bubbles, as seen in the tech boom of the late 1990s.

3. Discipline Yields Better Results :

By staying disciplined and avoiding knee-jerk reactions to short-term volatility, investors can capitalize on market inefficiencies. For example, buying during periods of extreme pessimism (when others are selling) can lead to higher returns over time.

Chart 2: Missing the Market’s Best Days Has Been Costly (1995-2024)

Source: Hartford Funds

It’s natural to feel uneasy during market downturns. But history shows that pulling your money out of the market—even temporarily—can come at a steep cost.

The charts above make this clear:

“Good days happen in bad markets”

Over 1995–2024, half of the S&P 500’s 50 best days occurred during bear markets. Many of the biggest gains happened right when investors were most tempted to sell.

“Missing the best days = Missing the gains”

A $10,000 investment fully invested grew to $224,278 from

1995–2024. Missing just:

10 best days : Only $102,750

20 best days : Just $60,306

30 best days : A mere $38,114

Why sitting out hurts

Markets recover faster than you think.

The best days often come out of nowhere—especially after big drops. Once you’re out, it’s nearly impossible to time your way back in without missing explosive rebounds. This underscores the danger of pulling money out during volatile times or low consumer sentiment. Staying invested, rather than timing the market emotionally, is crucial for long-term growth.

By Greyson Harris