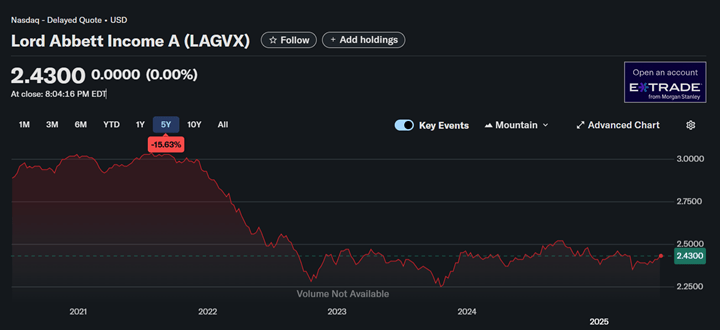

How a 20% slide in the Lord Abbett Income A (LAGVX) happened — and how CDs can help.

The Price of LAGVX from Jan 2021 – Jun 2025 was down 20 %

Bond Math on a Napkin

LAGVX holds intermediate‑term corporate bonds with an average duration of about 6½ years. Duration is a measure of how volatile a bond will be – the greater the number, the more the bond will fluctuate in changing interest rate environments.

- Bonds pay fixed coupons, but the market discounts those coupons at today’s yields.

- When yields rise, the discounting is tougher, so prices fall.

- Since early 2021, yields on similar bonds climbed roughly 3 percentage points (10‑yr Treasury 1.5 % up to 4.4 %; BBB credit spreads 0.8 % up to 1.1 %).

- Rule of thumb: price change ≈ –duration × yield change, so -6.5 × 3 % ≈ –20 %. That’s exactly what showed up in the fund’s price as shown in the chart above.

The Climb Back

A 20 % decline means the fund needs a 25 % gain just to break even. Using the same duration math, that would require yields to drop roughly 3.5 percentage points — essentially a return to the ultra‑low‑rate environment of 2021.

Where Inflation Fits In

If inflation stays elevated, the Federal Reserve may keep rates higher for longer. That delays the yield drop LAGVX needs to recover, while inflation will also erode the real spending power of the coupons you do collect.

CDs: A Safer Alternative

Pairing your bond fund with a ladder of FDIC‑insured certificates of deposit can take the edge off rate shocks. Here’s a quick comparison:

| Bond Fund | Certificate of Deposit |

| Price jumps around with interest‑rate moves. | Even though the price fluctuates slightly, you will still earn your principal amount if held to maturity. |

| Income floats as the manager reinvests; price swings can swamp coupons in the short term. | Guaranteed payout schedule if held to maturity. |

| Carries both rate risk and bond‑issuer credit risk. | FDIC‑insured up to $250 k per bank (principal and Interest); no market risk if held to maturity. |

Think of a CD as “sleep‑well” money. It won’t skyrocket if rates plunge, but it also won’t sink if rates rise. Holding a CD ladder can help you:

- Lock in today’s higher yields.

- Buffer portfolio volatility while you wait for bond prices to heal.

- Retain your purchasing power steadier if inflation rises.

The Take‑Away

Bond prices and their yields move like a seesaw. LAGVX slid 20 % because yields popped by about 3 percentage points. To claw that back, yields must fall by roughly 3.5% — a tall order unless the economy slows sharply and inflation retreats. CDs provide a straightforward hedge: fixed, insured income that doesn’t gyrate with daily bond‑market headlines.

By Greyson Harris