The above formula is the key to building wealth and meeting financial goals. It represents the power of compound interest, and understanding how the formula works is fundamental to understanding the time value of money. It will also help ensure that you build a nest egg sufficient to meet your unique financial goals. The sooner you have dollars to invest, the more value they hold. Dollars invested for longer periods of time will have greater returns over time, because you earn interest on your principal (original investment amount) and you receive interest on the interest you have already received. The two key factors are the rate of interest (or “i” in the above formula) and the frequency of compounding (in the formula “n” represents the number of compounding time periods). “FV” is the future value of the money and “PV” is the present value of the money. Because “n” is an exponent, it determines how many times the base of the equation will be copied (the interest) so the higher the number the greater the output.

“It’s cake, c’mon it’s cake!” my calculus teacher Mr. Patrilack would say to our high school class as we shuddered. You can forget the formula and just think about the dynamics of a rabbit farm and you will understand compounding and the time value of money. The more rabbits you start with, the more you will have down the road. If you sell off some of your rabbits every year, you will have fewer down the road than you would have had you kept them. Fibonacci can give you more detailed numbers, but this is the general idea.

2 rabbits, 4 rabbits, 6 rabbits, 10 rabbits and so on…

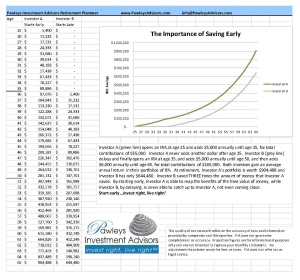

Consider two different investors starting to save for retirement at different ages. One starts saving early and stops at age 35 after having saved just $55,000. The second starts later, and saves $165,000 total. By the time retirement rolls around, the early bird has over $250,000 MORE in his portfolio, despite having only contributed $55,000. Yes, Virgina, time IS money. “invest right, live rightTM!”

© 2012 Pawleys Investment Advisors, LLC. All rights reserved.

🙂 nice blog

Sent from Jenn Cribb’s Verizon Wireless 4G LTE Smartphone… Please excuse any typos.

Thank you very much, I especially hope younger people see this important information. because it can change their lives. Please share!